Kansas City Portfolio Opportunity

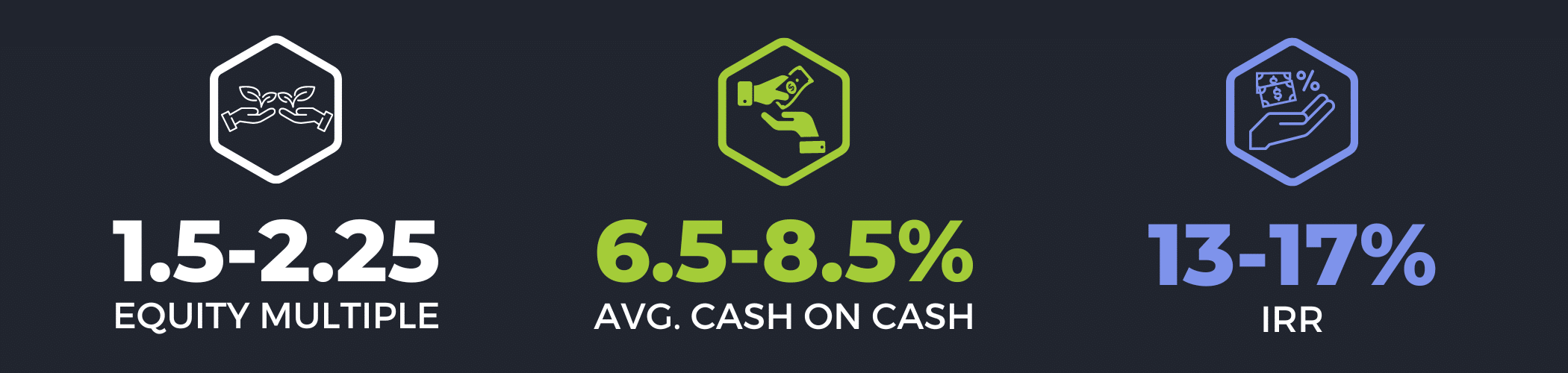

AT A GLANCE

Totaling 181 residential units, and nearly 40,000 sq/ft of retail space, the Kansas City Portfolio includes unique assumable debt, fantastic tax abatements, best-in-class amenities, (including the 2nd largest mechanical tree in America!) all located in a top 3% school district. Please download a copy of our investment summary, we look forward to partnering with you on this opportunity!

The LBC acquisitions team identified Kansas City as a target market based on a variety of metrics, including job & population growth, higher cash yields, and overall stability. The KC metro is booming with multiple large development announced recently including:

- $4B Panasonic battery plant

- A brand new $1.5B airport terminal that opened in February

- An $800M Meta data center in the Northlands slated to open in the next 18 months

- KCI 29 Logistics Park, a new 4.5M sq/ft industrial park adjacent to MCI, less than 15 minutes from Parkville Flats

- Rocky Branch Creek Technology Park, new data center hub with up to 4.3M sq/ft of space

Q&A WEBINAR

Life Bridge Capital is excited to present a unique investment opportunity in Kansas City for our community!

A Portfolio of Opportunities

After searching for nearly a year, we’ve identified an off market portfolio of Class B+/A+ assets we call the Kansas City Portfolio in the Northlands area that checks our investment criteria, namely solid cash flow, excellent growth prospects for above-average equity growth, and high quality newer built assets.

- Please wire your funds within 3 business days of signing your Subscription Agreement. This can now be easily done through your investor portal. Investors will be accepted on a first-funded basis.

- You will be notified as soon as the the PPM and Subscription Agreement are available, and will be given detailed instructions on how to sign these documents and fund.

- Note for returning investors: This project will not show up in your investor portal until you receive an email that you have been accepted into the deal.

– Investors will be accepted on a first-funded basis

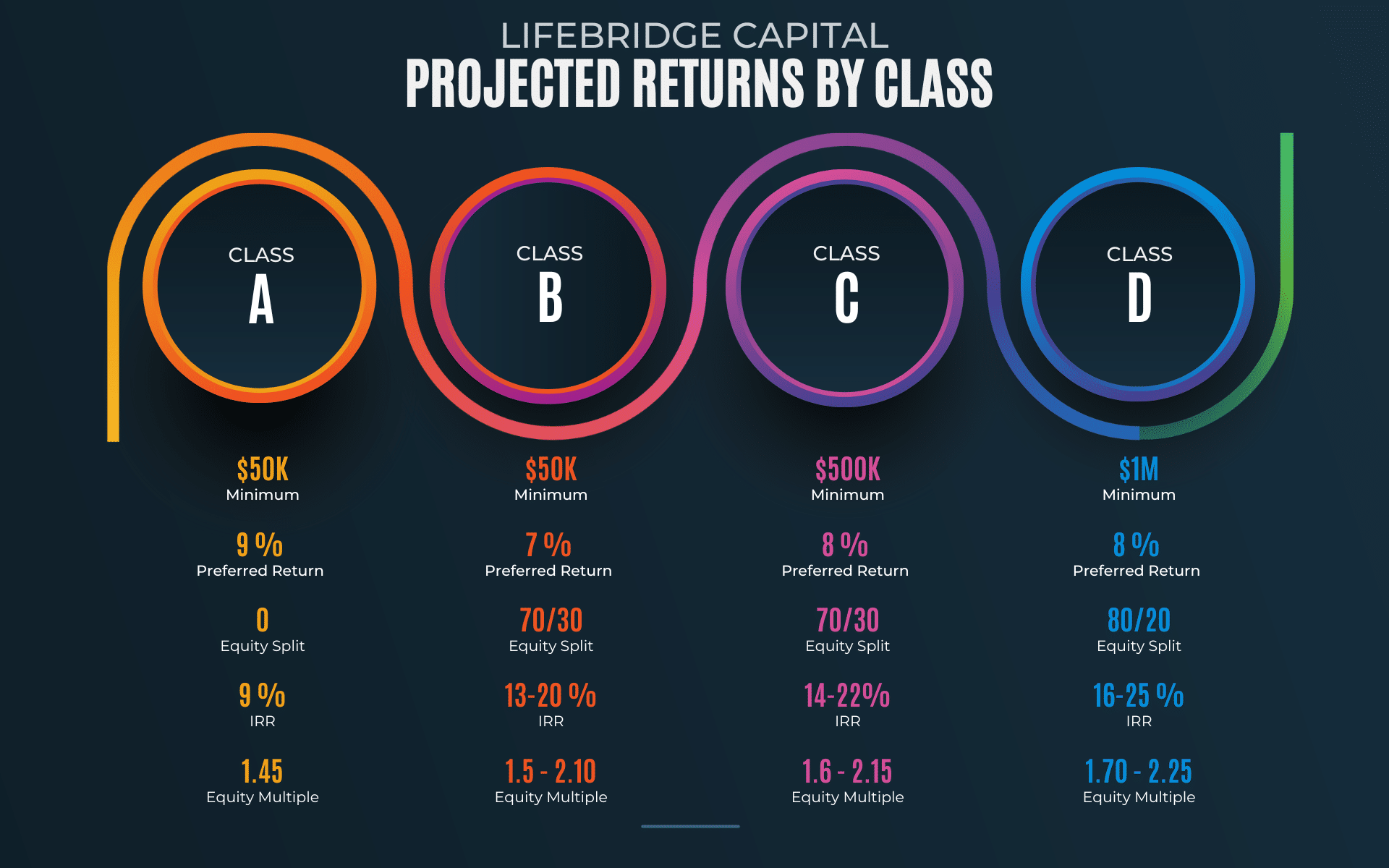

– Minimum investment is $50,000

– This opportunity is a 506(c) deal

FOR YOUR PROTECTION

To protect our investors, wiring instructions will only be available in the portal and will NOT be emailed. We encourage you, or your banking representative, to call us to verify the wiring instructions.