When you think about New York City, a picture that will surely come to mind is the Statue of Liberty and the skyscraper behind her. Among those behind the Big Apple’s high-rise buildings is Ken Van Liew. Today, we speak to world-renowned real estate expert Ken about the Modern Wealth Building Formula.

Watch the episode here:

Listen to the podcast here:

Ken elaborates that the Modern Wealth Formula is about mastering real estate investing through syndication. He says if you want to scale your business up, it is crucial to have a little bit of cash flow, equity available when necessary, share the wealth, and give opportunities across the board. He compares building a skyscraper to building an extraordinary life. He says everybody wants an extraordinary life and if they can do it through real estate, they get the best of both worlds. Ken also talks about finding funds and having a good facility system. Tune in now and find out how you can build your wealth through real estate!

Key Points From This Episode:

- Ken shares his journey in the real estate business.

- Ken talks about his focus on real estate.

- The Modern Wealth Formula – how to master real estate investing through syndication.

- Some lessons Ken learned in his real estate career.

- Ken shares some of the difficulties a developer face that is not known or seen by some real estate investor.

- What would Ken do differently in his career if he knew what he knows now?

- How does Ken prepare for a downturn?

- The daily habits that helped Ken achieve success.

- Ken gives tips on how he tracks what he does in a day.

- Ken’s best source for meeting new investors right now.

- The number one thing that contributed to Ken’s success.

- How does Ken like to give back?

Tweet This!

“I don’t wanna just be a leader; I want to be a bold leader.” [0:15:16]

“Looking back, I’ve proven that this modern wealth formula is syndication. I had not only done it on real estate development out of the box, I took the top down.” [0:05:36]

“I really analogize building a skyscraper as building an extraordinary life.” [0:08:13]

Links Mentioned in Today’s Episode:

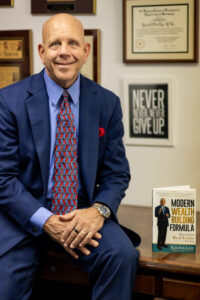

About Ken Van Liew

Ken Van Liew started his professional career with a civil design engineering job, twins, and 2 master’s degrees, underpinned with a six-figure debt and a burning desire to serve others.

Three years later, he cut the ribbon on the development of a $17 million, 72,000 square feet, 113 bed assisted living facility. He parlayed this success into a Staten Island waterfront development and began a mastery journey with Tony Robbins. While attending a Tony Robbin’s event in Hawaii, his waterfront development was terminated due to the World Trade Center tragedies.

This moment gave Ken time to reflect where he was, where he wanted to be and the impact he wanted to have.

Alongside the syndication and development of over a billion dollars of high-profile real estate investments, Ken created the Modern Wealth Building Formula as the fastest track to building wealth … a project that has empowered 1000’s developers over the last 20 years.

Simply put, Ken is a titan in the world of real estate responsible for over a billion dollars of construction across dozens of projects and has forever changed the New York skyline. In addition, Ken regularly speaks on stages including NYU Real Estate Institute and the College of Engineering at Rutgers University, and is a bestselling author. Ken is an unsung hero in the world of stage magic, has been married for over 30 years, and is the proud father of 3 talented and successful children.

Full Transcript

EPISODE 942

[INTRODUCTION]

0:00:00.0 ANNOUNCER Welcome to the Real Estate Syndication Show. Whether you are a seasoned investor or building a new real estate business, this is the show for you. Whitney Sewell talks to top experts in the business. Our goal is to help you master real estate syndication.

And now your host, Whitney Sewell.

[INTERVIEW]

0:00:24.4 Whitney Sewell: This is your daily Real Estate Syndication Show. I’m your host, Whitney Sewell. Today, our guest is Ken Van Liew. Thanks for being on the show, Ken.

0:00:33.1 Ken Van Liew: Thank you, Whitney. A pleasure to be here.

0:00:35.3 WS: Ken started his professional career with a civil design engineering job, twins and two master’s degrees, – twins would have been enough right there, – two Master’s degrees also underpinned with a six-figure debt and a burning desire to serve others. Three years later, he cut the ribbon on the development of a 17-million dollar, 72,000 square feet, 113 bed assisted living facility. Alongside the syndication and development of over a billion dollars of high-profile real estate investments, Ken created the modern wealth building formula as a fastest track to building wealth – a project that has empowered thousands of developers over the last 20 years.

Ken, welcome to the show. Obviously, I wanna hear a little more about your background, and like I said, the twins alone with a… Man! That’s a degree in itself. But then two master’s degrees, and then the way you’ve got into real estate. Give us a little more of that journey and build that picture for us a little bit so we can move into this modern wealth building formula as well.

0:01:41.1 KL: Absolutely. It’s been a blessing for me. I wasn’t a great student. I loved football, and I was an all-State football player in high school and won a couple of championships. And when I got to college, I figured I would create the six-year plan. I just couldn’t pick up on calculus and physics. I struggled, and I met my wife in my third year in College, and I’m still with her today. Thirty-eight years later, she taught me how to study, and that was really the start of a career where I decided maybe I couldn’t be an engineer.

And a few years later, I graduated Engineering School. I had won an award on civil design and had a sub-divide and had planned to the scene, but I really didn’t connect all the dots with civil design, a little bit of summer job construction and what’s going on with real estate. It was just about the time that Robert Allen came out with a book, ‘Buy a House with No Money Down’ and I couldn’t even afford a car. My first car was like 700 and it had multi-colors from several accidents that didn’t start.

So that’s kind of what I started. Dad gave me 10 a week, went down to college after six, packing washing clothes where you’re pretty much just hustling. And that led eventually to a civil engineering degree, but I was bored sitting at the table, got back into construction, had an opportunity to do my first building into Kipsy and that led into skyscrapers into New York City, and it’s just been a ride ever since.

0:03:08.3 WS: Wow. In the skyscrapers in New York City. I guess give us a little insight into what your focus is right now? Like what are you doing in real estate? What’s your business now? Help us to visualize that.

0:03:18.7 KL: Yeah, I jumped and I’ll drop back to… The first big one we did was back… You mentioned the $17-million assisted Living, which was the beginning of the modern wealth building formula. And I didn’t really know what it was about that. And I was finding funding and facilitating development and it turned into the formula. But today we continued to apply the formula. We revolved in a large multi-use development in Chester, New Jersey, which has a 100-year-old restaurant that we’re restoring.

It has affordable housing, market rate housing, commercial office, and being driven by my first CVs that we signed the lease we’re really excited about. We have another 13 acres where we’re developing anywhere from still in conceptual design, between 75 and 100 residential units and carving out three acres for somewhere between 100 and 120,000 square feet of self-storage. We’re consolidating land in three different towns, watch on Warren, and Hanover like this time consolidating, trying to create something pretty extraordinary, talking to some continuing care, retirement community groups in the assisted living space.

I have some other small sub-divisions and we’re also gonna take advantage of what we believe can be tremendous opportunities across the country with the upturn happening, with everything and all the excitement. So that’s having fun.

0:04:42.2 WS: Tell us about the modern wealth building formula, like what is that? And let’s go through that a little bit.

0:04:47.6 KL: The modern wealth building formula was something I coined after 30 years. I never was good at board games or word puzzles or anything like that, but with all my personal development, – I was always thinking Tony Robbins, – and I was sitting there one day, I’m always like, take massive action, take massive action. And popped up, and then I had just finished this course with Landmark. It was on wisdom, and the W popped up and I wanted to be…

I didn’t wanna just be a leader, I wanted to be a bold leader. And then I was forward-thinking and I was playing around and he was like, wow, modern wealth building formula, how to master real estate investing. And what really came from that was I’m starting to put together what I’ve been doing all these years, which have been very successful, and looking back and proven at this modern wealth-building formula, which was syndication. I had not only done it on a real estate development out of the box.

I took that top-down thinking and then applied it to multi-family and residential, wholesale, fix and flip, and show that in almost any type of real estate, eventually, if you wanna scale it, it’s nice to have a little bit of cash flow, equity available when necessary, share the wealth, give opportunities across the board, saw it to start to work and I said, ‘Well, it’s really kind of a system on what I’ve done, I think a little differently.’

There’s a lot of data out there to find deals, but I find projects a little bit different than everybody’s at a finding process as part of the system. And I had a funding process. I called it unlimited funding, ’cause when I started… I didn’t think I was gonna be able to finance a 17-million deal. But when I finished that, it gave me the confidence where I was like, ‘Okay, I got this figured out, I could do unlimited funding,’ and the facilitation of the development, I always figure out if you can manage a development…

It has all the components. If you find the developments, the same skill sets that you use in finding a residential multi-family, funding is kind of the same thing, so not like I’m totally reinventing the wheel, but I had to find fun and facilitate 3F system that I called it, which ultimately added in a little bit of injection of personal development, a little bit of Tony Robbins, and that created this what I would say sports enthusiastic, modern wealth building formula.

When you read the book, it tells you a little bit about the pre-game exercise and where you kind of size up in the line-up, if you look at it from a baseball perspective, and it just… You have a little fun with it, and it really comes down to top down thinking, ’cause if you think from the top, you could pretty much do anything in real estate, and that came from building a couple of skyscrapers in New York City.

0:07:28.6 WS: Well, let’s talk about that a little bit. I know building not just everyone’s been a part of building skyscrapers in New York City or anywhere, for that matter, but what are some things that you learned from that specifically that have helped you throughout your real estate career?

0:07:42.4 KL: Great question. The biggest take away, the first takeaway was, this is swimming with sharks every day, there was a book, they wrote it at one time, but what I really took away at the end of the day when I…I wouldn’t say left New York City construction… paused last year on some New York City construction ’cause of the pandemic, and two years ago, I had a concrete company were report a couple of 30 story towers, and after building 1500 units and 3 million square feet in New York City, I really analogize building a skyscraper as building an extraordinary life.

And I don’t wanna go off too with real estate, but I’m doing it for a specific reason, ’cause it applies across the board for anybody, and I think everybody wants an extraordinary life, and if they can do it through real estate, they get the best of both worlds, and what I learned in New York city construction… And if you’ve ever seen a project, obviously, you probably have in your neck of the woods, but in New York City, you’ve seen this green fence that goes around the site, say it’s a parking lot, or if there’s a demolition, you see some activity.

But this green fence goes around the site and you just see this green fence, it opens up once a day, and it’s storing the six months process that you build this foundation, and I can only say that the foundations in New York City or the songs foundations in the world… And like in life, you need a strong foundation because there’s gonna be a couple of earthquakes and poured concrete structures, I learned that without that structure that can handle the earthquake loads and the wind loads, that’s the backbone that you get in life that you have to build upon.

And the New York city, it’s all about the cycle, so as I was pouring concrete, by the time I was up to the 10th floor, if things were managed properly and my project manager on top of things, and we were literally starting the elevators and starting to install the skin on the building, and that’s because in life, you need a tough skin because you’re gonna weather the storm and we’ve raised to the top and of course that and down the hatches with the roof, and then start life, building that building and coordinating hundreds of men and getting accelerated by it.

Like there’s nothing like waking up in the morning and having four or 500 guys on your job and things are humming, and you’re building the heart and the guts of a high rise. And I say to people that are building houses, you can do it, it’s just like building 30 houses on top of each other, you’re… You’re gonna get that cycle instead of just going in and frame in one, the framer just goes to the second floor frame or goes to the third floor, followed by the electrician, followed by the plumber, and it’s just a cycle you create…

And that’s what life’s all about. It’s a cycle and real estates a cycle and it’s all a fine thread through everything. As you really sit back and look at what’s going on in life, like I’m not confused.

0:10:45.4 WS: Yeah, I think it’s interesting, you talk about the six months to build a foundation, but it looks like there’s really nothing going on.

0:10:52.3 KL: It really does. There’s so much behind the scenes and pre-construction on those jobs, sometimes we build on paper for another six months, but the beauty of it is when it gets to the street level, and we used to pride ourself on my concrete company that every four days we’d have another floor, so it takes six months to get the ground level, but then you’re talking in three months, you’re up… We go six days, four-day cycle, and you’re looking good, all of a sudden, 20 floors pops up in two months and it’s game on.

0:11:26.1 WS: Wow, what are some of the difficulties as a developer that maybe aren’t known or seen by just the average real estate investor?

0:11:33.0 KL: Did you say difficulties or…

0:11:33.1 WS:Yes.

0:11:36.6 KL: Yeah. I would think with developers, there’s more moving parts, which means more personalities, and what it really comes down to, if you know your game, it’s really just more creating unity and teamwork, eliminating delegating or remaining as much as you can, because you as the top of the hill or calling the shots, you can’t get stuck in other things other than critical path items that if it’s delayed, it’ll delay the project and ultimately cost you extra money, and that’s really what the developer does.

One of the things that we analyze is this nine-foot matrix of the development process and segments of that matrix apply to multi-family, if you’re buying a project, there may not start with conceptual design, but it starts with intense due diligence that you really have to dive into… And you have to dive into all your contracts and warranties and guarantees things that you’re doing on a development from the onset when you’re buying contracts out.

You’re not gonna wanna deal with warranty and guarantees at the end of the day, when you don’t have the leverage, you wanna take advantage of the leverage you have up front, right, by it, strong, and that’s where you make your money. You’ve probably heard If you make your money in to buy, so the same applies when you develop…

0:12:57.8 WS: Awesome, are you going back to New York City or is it strictly assisted living.

0:13:02.0 KL: Now, I’ve figured away from assisted living it, we make it into it. Now, there’s a lot of talk about the hotels converting to assisted living, I’m big into the multi-use… We are looking at a property in New York City right now, something came in really, really cheap, you know, I have, other than going to visit my daughter to live on a 170 Street, I’ve been focused on some major New Jersey projects and other states throughout the country.

That we’re shooting for some things, however, I’m not afraid of Manhattan and I’ll be back definitely, and we’re looking at my heavy right now also, but we have some high rises in our view and multi-family and we’ll get involved in anything.

0:13:46.0 WS: What about it? Maybe you speak to just the market in New York City right now, just after the pandemic, and anything that investors that are considering that market or should know just after everything that’s happened there.

0:13:57.8 KL: Yeah. I believe that now is a good time to pick up some residential in New York City if you’re buying condos, there’s a lot of struggle with new stuff coming out of the ground, one of my dear partners are struggling with the project that they just can’t sell out right now, which means that there’s some inventory that’s sitting there, but with people shooting out of the city and from what I’m hearing on the outskirts, people are going back, so there’s gonna be some discounted offers.

It’s something like in New York, 10 years later, you’ll be sitting on a nice little profit from that standpoint, from a big time investment right now in New York, I’m sitting back, we saw something come in that was under 400 dollars a square foot, which I think probably a year ago, things were up in around 600. So that’s a good sign, but we’re not quite sure if you build something, whether or not it could absorb…

0:14:54.2 WS: Yeah. No, there’s some great thoughts for sure to be thinking about… Tell me, is there anything you would have done different Ken,as far as like from your career, what you know now, looking back from development and all the higher eyes is different even to assisted living, what would you have done differently on the first few deals or would you have?

0:15:09.0 KL: Yeah, I probably would have looked more at just real estate as an asset, I didn’t really… My dad climbed telephone Paul’s, my mom was a bank teller and we did actually own two houses, they had a two-family house, but no one ever talked about real estate, and I didn’t know that real estate paid residual income. My mom and dad had a job. I probably would have started focusing on residual income earlier.

When I first started, I was grandiose about fees ’cause I didn’t have a lot of equity, and one of the chapters in my book was Feed Gold, like sit there, oh wow, I can ever fees like eight or nine different ways, and I used to give myself a development fee in general conditions and the CM fee, and then I’d work something in on my options and upgrades, and I would squeeze something out of the finance guy, and I did that.

’cause I was taking smaller percentages and bigger fees, and I guess I would have just took a little… A different approach, I would have maybe leaned into a little bit more mentorship, but I just didn’t know any better, I just knew construction and had a test concrete and I just kept going in that direction, and it ultimately led to where I landed today.

0:16:22.8 WS: And the types of deals you’re doing now, how do you prepare for a downturn?

0:16:26.6 KL: You know… With the development… Right now, we are fortunate with the multi-use, obviously aren’t gonna go run and build a commercial right now, so we are moving along and getting the approvals to CVS, they are very anxious to move in. The restaurant isn’t the most marketable, the affordable housing is help driving the project, so we’re looking at all the markets, but in our back pocket where that commercial is, I have a deal with Wawa.

Which they’re always looking for a hot corner and we are just constantly putting plan Bs in our pocket. And Bedminster we’re doing some stuff and there’s a lot of opportunities with affordable housing, but the towns have these settlement agreements that they’re not… They don’t really have a lot of pressure on them. So you’re going in with high risk, one site we have doesn’t have any utilities on it, so there’s all kinds of exciting things.

0:17:23.8 WS: What about… Do you have any predictions for just the real estate industry over the next six to 12 months?

0:17:29.1 KL: Yes. I believe, which I would have never predicted that there is gonna be a continued rise in residential valuation, and I think that it’s gonna stay strong because what’s happened is with the pandemic is everybody has realized that they’re gonna be spending more time in your home possibly working out of the house, they’re trying to improve their living quarters, give a more square footage, people are moving into residential, there’s millions of dollars and family offices moving towards residential.

I see a lot of activity in that area. Multi-family, I think will continue to do well, but you’re gonna have people moving out a multi-family not paying your rent, so there’ll be a little bit of struggle trying to get their own home ownership commercial right now, we’re not quite sure. The companies are trying to figure out what’s going on. They’re stuck with fleeces and things like that in retail, is gonna be continued to be challenged, but there’s gonna be a lot of opportunity in residential.

0:18:28.9 WS: Do you have any daily habits that you are disciplined about that have helped you achieve success?

0:18:34.1 KL: Yes, I have a morning ritual where I wake up every day and I do about at least 50 minutes of movement and I go into a quick meditation, then I feel my body and usually sang a lot to my wife at that point, and I get started with my day after that, but it’s using a morning ritual and I journal a lot, and I start off every day writing down three things that I’m totally grateful for.

I do the same thing before I go to bed, I measure tremendously what I have blocked for the day, how I’ve done for that day, and part of that habit is generated quarterly, where I sit down and I do kind of a three-month… Look ahead on what do I wanna accomplish in my three main areas of life, which is business, relationship and health, and then I kind of reverse engineer those outcomes and try to do what I have to do every day. And the morning ritual, just keep you on track and… Being grateful is key.

0:19:33.7 WS: No, that’s awesome. Doing those things every day, and you said measuring what you’ve done or what you’re doing for the day, they need tips on that, how you measure anything specifically, may be how you track things…

0:19:45.2 KL: Yeah. Great question. Having done it a long time, and it’s so key that when you near and match something that you set up measuring, and I measure every day for my personal and my professional life, on a scale from one to 10, and I call it kind of like my quality quantifier, where… On my relationships, I’ll say I had a seven today, and it was based on my three outcomes that I may have wanted in that area, ’cause in each area of my life…

Each day I have three things that I’d like to accomplish. So relationships, I wanted to connect with my wife or connect with my kids, I didn’t make those calls, I give myself a measurement and I just gauge, and then I do the same for business, and then I measure what I had written down on my schedule that day on whether I stayed to my time blocks, because time blocking in the goals and everything you said, if you know the time block to where you wanna be in five years, you’re never gonna stand track and get there, so…

So the whole key to time blocking is you have to stay focused on the night before, you should time block of what you wanna accomplish the next day, have it written down, and the key is the measuring… If you’re not measuring like today, to call just my social media KPIs, it takes five minutes, but you established what the measurement system is, and then one of my favorite books is The One-Minute Manager. You give people the opportunity to grow. You put… What’s the outcome? What’s the measuring system? I’ll talk to you next week.

0:21:14.8 WS: I like that. And if you’re not measuring it, how do you know if you’re improving or not? Right, especially for a long period of time. And the one-minute manager, it seems like I’ve read that, but it was probably two or three years ago that…

0:21:27.2 KL: I think I read in 20, but it was always… I kinda chuckled at myself because you can’t be a one-minute manager without having a measuring and system in place to be the One-Minute Manager, and it takes a little bit of thought and alignment with the people that are working with you, ’cause they wanna be able to grow, and most of those people don’t wanna be told what they do, nobody wants to really be told what to do, you have to make… let them create the idea, there’s a fine thread as you as I’m sure you know in your travels.

0:21:57.7 WS: What’s your best source for meeting new investors right now?

0:22:00.9 KL: You know, I gotta tell you, you’re not gonna believe this, but I have gotten involved in an organization called on-blinded mastery, and this gentleman is blind. His name is Sean Callagy, and he has two of the top 100 jury verdicts in the country, and it’s been pretty fascinating, and I forgot the question I got so diverted on Sean Callagy, but what I’m doing is…

I’m doing what’s called is merging ecosystems through real raw opens, and I’d love to share it with your listeners, but go to unblind.com, and what real raw opens are is essentially a shared experience that you’ve never had before. So with command change in the world, it’s not like you’re having business launches with 10-15 people, which a lot of law firms did that to build their businesses and Shawn…

Never built his business that way, Shawn built his business by having what equal was real raw, open, shared experiences where he brings people together, some are judges, some are role players, some are contestants, and he creates a contest, but before you start this fun Friday game contest or you wanna call it, everybody introduces themselves and create an emotional report like you’ve never had before in a normal event.

It’s not like networking, ’cause what we realize that networking doesn’t work and through creating these real row opens and shared experiences where we’re doing them almost every day now. We’re 10 people are coming on board, and now we’re moving it out one day, we hope to do 10 a day, and it’s growing this organization massively, and it all came from the way he built this 125-man law firm, stepped out and started to build unblinded mastery and believe it or not, that is bringing all walks of business to life through this ecosystem, merging and shared experience in the real Alpena.

So I’ve actually been having real role opens, I have people like, hey, you bring three, I bring three, you bring five, and we do it on a Friday, or we do it on a Wednesday, and it’s just an awesome way to merge ecosystems, and I’ve met investors and to be perfectly honest with you now, at the stage where this year, we’re really engaging with family offices, so we don’t have to do as much investor relations, but you always have to do investor relations, and this works, we’re meeting high quality people and… Check it out.

0:24:37.6 WS: No, we’ll check it out. That is interesting. I wanna see how that works a little bit, well Ken… What’s the number one thing that’s contributed to your success?

0:24:45.7 KL: I would have to say my family, having them there every day was my real why. Having twins and then a third, and my beautiful wife that just smiles at me every day, I don’t know why she’s … at me, I’ve just been so blessed with three amazing kids, and that was my foundation, as we talked about it before, and it’s… To this day, I just, I love connecting and hearing what’s new in my children’s life each day and paying it forward just to have a conversation with a young lady who happened to be in healthcare.

And she was just so happy, and I think it’s really just touching people and leaving people with more power, freedom and self-expression and peace of mind from the shared experience and interaction with you.

0:25:37.7 WS: You know, I ask every guest how they like to give back, you share it a little bit there, but any other ways you wanna share that you like to give back?

0:25:44.7 KL: Yes, if anybody resonates with what we discussed today, you’re welcome to schedule a call with me, I’m very easy to get in contact with, just go to my website, I believe there’s a Discover now button that’ll lead you to a short video or teach you a little bit about the modern wealth building formula, and you can schedule a 45-minute strategy session with me where we can talk, that was about the young lady to talk to me yesterday, she had some ideas, she wanted to open up an assisted living, she was a healthcare worker.

And she just left the call let up, so if I can bring an idea that you have forward and help you create your dream to help others, that’s what we’re here for. Bring you to your greatest.

0:26:24.7 WS: That’s awesome, Ken… What is your website? And how can people get in touch with you?

0:26:28.7 KL: Kenvanliew.com.

[END OF INTERVIEW]

0:26:30.0 WS: Awesome, Ken, grateful to have had you on the show and a many aspects of just your career in your success, I think we can all resonate with you, learn so much from… No doubt it. I hope the listeners will reach out to you… Thank you, you.

[OUTRO]

0:26:43.0 ANNOUNCER: Thank you for listening to the Real Estate Syndication Show, brought to you by Life Bridge Capital. Life Bridge Capital works with investors nationwide to invest in real estate while also donating 50% of its profits to assist parents who are committing to adoption. Life Bridge Capital, making a difference one investor and one child at a time. Connect online at www.LifeBridgeCapital.com for free material and videos to further your success.

[END]

Love the show? Subscribe, rate, review, and share!

Join the Real Estate Syndication Show Community: