Listen to the podcast here:

In property takeover and management preparation, a syndicator must have a month in development for the process to be planned accordingly. Real estate expert Vinney Chopra generously shares his knowledge on what we need to do and prepare for during a property takeover and management. Vinney explains why we need to have personnel, service contracts, surety bond, property list, and software in order, guiding us deeper into the steps of the process. He also outlines the three Rs you need to start checking – rent, retention, and response – and how you can gradually change the culture and behavior of the community with it.

Our Gracious Sponsor:

Are you wanting to learn how to gain financial freedom through having your own syndication business? Text LEARN to 474747 to begin to learn from one of the best in the industry, Vinney Chopra. Vinney came to the US with only $7 in his pocket, and now controls hundreds of millions of dollars of real estate he has acquired through multifamily syndication. He is now personally coaching others to do the same. Text LEARN to 474747 to begin your journey to starting your own syndication business! Vinneychopra.com

—

Watch the episode here:

]

Vinney Chopra on Property Takeover And Management

Our guest is Vinney Chopra. Thanks again for being on the show, Vinney.

Thank you, Whitney. It’s a pleasure to be here.

I’m always pleased to have Vinney on the show and sharing his time, knowledge and expertise. He’s got as much experience in the business as anybody that I know. Vinney came to the US with only $7 in his pocket now as a company managed over $200 million worth of real estate. We’re thankful to have him on the show. We’re doing a series of shows. It’s an important topic we’re going to cover, the property takeover and management, the closing day and things like that. Vinney, get us started, what we need to be thinking about when we’re taking over a property and leading up to that closing day?

As we get into the whole process of closing, the light at the end of the tunnel, we call it. All of that hard work from finding the deal to doing the underwriting, getting into the loan qualification and all of those things. Now is the time when about a month before, about three weeks before, we need to start thinking about what are we going to do that day of the takeover because you got to make a decision. Asking the seller, first of all, if they’re going to take their employees with them in their company to another property or would they be willing for us to interview them and then see if they would like to join us. The third thing would be getting a property management company side-by-side because they are the ones that are going to take over the property management.

If we don’t have our own clout and everything, if it’s a smaller property, like 50 units or 25 units, I teach my students to go ahead and do some advertisements and get some well-qualified community manager. We don’t call community manager with good experience, fifteen years, eighteen years of experience in that market. That will be worth it and getting a lead maintenance person and so on. Let’s go to one part where we are assuming that we’re going to take over. The biggest thing is there are several contracts. Service contracts we call them that are transferred to the new owner. We need to ask in the due diligence from the seller and the broker involved, what are these things? Is this the lawn care or landscaping contract if it’s going to be taken over?

Coin back contract is another one, which is the laundry facilities contract that goes over. If there is some equipment in the office, some machines and things that have to be taken over or we have the pest control contract, those will transfer over. The day we signed the deal and it’s recorded, the keys are handed over, they are going to hand over all the leases of that property. All the leases and they are going to start dismantling. The seller is going to take out the utilities, the water, trash, gas and electric. We need to be ready to go to the city and change those in our new company’s name. Remember our LLC got formed may be a few months back. There is no traction. There’s no record. The utility people at the city hall or city office are going to ask for deposits. We call it the water deposit or utilities deposits. Be ready to pay $5,000, $8,000, $10,000.

I know in one property I bought, it’s $20,000. They didn’t want to take anything less than that. They said, “Your bill is high at this address and we are dealing with you. You are a brand new owner. We want to put this much money in a deposit.” There is something called surety bond. A surety bond is through the broker or your bank. You could get this bond which will give them the power to write it off, the $20,000 value is called. You could buy that for $1,300, $1,500. One can look into that. You don’t have to pay the whole money, but you’ll give them. You have to ask the city if they will take the surety bond.

Let’s talk about, what are you going to do right away as you take over the property? It’s your baby. The residents are going to start coming to the leasing office. What’s the software you’re going to use? That is a huge part of the whole game. How are you going to take care of running the operation smoothly right after the keys are given to you? They’re going to leave the laptops, they going to wipe out everything on their machines. We never buy laptops because they’re portable. We want the machines which are fixed, so PCs, all-in-ones or the other ones, CPUs.

We want to make sure that we have decided on software. That’s what we have to do. Is it Rent Manager? Is it RealPage? Is it Yardi? Is it AppFolio? You get from the seller current rent roll in Excel so that you could convert that into CSV file. Let the software company import it into the software database so that day one you have all the residents’ names, their phone numbers, their address, their everything, all the data that the seller can give us.

The seller usually is going to take their machines with them and you’re not going to have that information electronically if you don’t ask for it. Hopefully, you already have it when you’re doing your due diligence. That’s a neat point you make too about having a desktop machine so it’s not so portable. They could easily take them also. A laptop I can see you can walk off much easier.

In my properties, all 26 of them, we always have big CPU machines, which are big. A lot of other communities now have two desktops, two screens. They like to work on one screen and then another screen. We buy 27 inches or 24 inches, both of them separately. I have always believed that we want to get cutting edge software, cutting edge faster machines because if they are not faster, they are old. It reduces productivity and efficiency. I believe in that. Many times, you ask them for the personal property list, it is called. The seller and the broker will give you a property list, which will show you all the machines is staying. All the things in the warehouse are staying. All the things in different parts of the model unit and everything is staying. That list is important. On the day of takeover to check off if they left everything they told us.

That’s such a good point because I can imagine you’re excited you’ve closed. You’re walking into the leasing office. I’ve heard horror stories like this before. You walk in and all the machines are gone. There’s no equipment. If you didn’t think about that, I appreciate you bringing up the personal property list or the equipment list so you know what’s going to be there.

That’s important. I’ve sold many properties. Out of 26, I’ve sold fourteen of them. It completed the cycle. We have given them to the end time. We kept on working hard for the buyer because that’s the right thing. Then you give everything they saw when they did all the due diligence. We don’t take away anything at all. We wipe out our information on the machines, but we leave the media center machines, everything. It’s going to save me maybe a couple of thousand dollars but transporting and all that. It’s good practice to give them everything, wipe out your information. The software is important. I would highly recommend Rent Manager is what we have been using. AppFolio is a nice program also. Rent Manager does everything for $50 or $70 a license as compared to thousands of dollars.

Rent Manager, that’s the management software that you all use?

[bctt tweet=”Get the best software and machines to increase your productivity and efficiency.” username=””]

That’s the management software where we can import all the units, all the residents. It’s amazing cutting edge software at a very low price. They’re from Ohio. The good part is you can do the texting. You could do the ePay. We have scanners in our property offices. You can scan the checks. It’s connected to the Rent Manager. All the units, all the money gets put into the right residents, how much money is coming in. It’s linked to our Wells Fargo accounts and everything. It’s got a recording of units, rents, the rent rolls, the financials, everything you need. It’s right there. It’s a robust system if your audience would like to look into it.

You’ve already provided some good information here, Vinney. Even talking about the security bond and the property list, some good information I don’t hear people mention too often. What are some other things we should be thinking about for this big day, the closing day coming up?

I would say definitely you are preparing your personnel. That is the biggest asset. You’ve got to hire the people beforehand if you’re going to bring your whole crew. I make a decision rarely. When we are buying the property, we are doing due diligence and all that, we interview the employees if they were going to bring those team members aboard. If the property has not been run right, I don’t want them. I want to bring my whole crew of all experienced people. We trained them in our other properties and bring them brand new. Those are important pieces of the puzzle.

I have perfected my Craigslist ads where I could put them and I can get 30, 40, 50 resumes coming straight to my box, one after the other. We never give a phone number. We only give the fax number and the email address. Email address is a Gmail email address, never to the property or your company because you want to make sure that you liked the candidates and who they are before you even start replying to 50 people. We pinpoint. We search through all the resumes. My HR person, the accounting department and my asset managers. They design and then they come from the 30 down to ten to five. They will make interviews and FaceTime.

Never ever talk to the candidate without looking at their face. How they dress up, how they talk, how they look. That’s important. That’s something we do through Zoom, through Skype and through FaceTime. They are flying there to that area to make sure that we hire the right people. The community manager, the leasing agent, we ask them. Once we hired the community manager, they are on the top. That’s the top leader. We asked them, “Do you know of other people that you have worked in the past or they are out of a job or things like recommendations are huge especially if they know they can work together.

Let’s go to the day of the takeover. Now, we have to deal with one week, two weeks, three weeks or four weeks. We have a set schedule of what you accomplish in the first week as we take over. The second week, third week and the fourth week. All the different things that we go over checkpoints and make sure those things are done. Lots of things have to happen because a brand new company took over. It’s a property management company or our own company. It’s a shock. Many times it’s a shock to the residents of that community, “How are these people going to increase rents or this? How are they going to deal with? They’re going to come with their gripes?” Lots of things happen.

If there is a property management company, which is bad before or owners are bad, they say, “We are thankful that you’re taking over. Let me share with you, they never took care of this and this,” so it’s a whole game. It’s a whole gamut of things happening. You’ve got to set standards. You’ve got to send that estoppel letter. Estoppel letter, which is where you’re asking the residents to give the right to you directly as a buyer as to when did they come into the community, how much they are paying as rent and so forth. It’s another way to double check because when we do the financial due diligence, it’s only looking at the leases, only the leases amount.

This is how much deposit they gave. This is how much is their rent per month. This is for utilities, rob system. This is where they go to a job and all that stuff. Our due diligence, our teams, ourselves where I hire people from outside to do it. It’s a good investment and due diligence. Once you take over the property, you can start looking at leases more and the criterion. Because if they didn’t check the credits, you want to get firmer and that’s the time to change the culture of the community. You want to set standards.

I would love to share it with your audience one property had gone to $3.5 million renovations before I bought it for $63,000 a door or something like that. A lot of money had already been spent. My community manager said, “Mr. Vinney, there are white trash bags outside everybody’s door.” I said, “What are you talking about?” Here is a beautiful property and these residents were not trained at all. They could not walk over and put it in the dumpsters. Right away, we send the memo out. New company, new everything and new culture. We want everything hygienic. We want for the better of all of the community. They’ll be $25 fine for every bag we see outside. Overnight, those bags went directly into the dumpsters. It’s showing that we are here for you. We are bringing value to you. We are doing all these things. We were finding some of the residents were lying on the lawn. We had a beautiful creek going through this property and all. They were lying. We have to talk to them, “It’s not kosher.” If you’re the swimming pool, which is a beautiful swimming pool, it’s okay, but you can’t lie on the lawn and things like that.

You have to set a standard so everyone knows exactly what’s expected. I see that coming one of two ways. Drastically, one or the other. If you don’t set standards and as you take over, they’re going to take advantage of you like many others.

You have to be fair and slowly you have to change the culture. That’s how I say. Rome was not built in a day and you can’t drastically change, but incrementally, you got to do that. Then you want to start putting your plan of action, which we already talked through in the executive summary when we presented to the investors. We are going to change the curb appeal. We’re going to put the nice flag poles up there. We’re going to light this up. We got to see the building lights over here. We’re going to change the signage if we are putting new signage. We get started right away.

I remember one property I bought in Lake Jackson. We had 23 approvals. I did for the work to be done in the first seven to ten days, 23 approvals. They were these construction contractors coming and doing things. Residents could see that this guy who got this property, he’s going places with it. That helps a lot because once they see the new parking lot with the previous owner who didn’t do anything about it, that was the first thing I did at that property, Monaco Villas. It’s worth $12 million. I paid $6 million something. It’s ridiculous how you can increase the NOI by giving value to the residents and then doing the outside interior and exterior. The leasing office was not used. It costs me only $69,000 to fix the leasing unit inside out because it was in starts when I took over. Now, it’s got a beautiful residence center, offices, bathrooms and all that. The thing is you’ve got to bring value.

What brings value in the eyes of the resident is exterior before, the flags, the pole, the curb appeal, the bar, taking care of the pavement, parking lot and garages. Overall, if there are shades on garages up on the top, if they’re torn. Those things are to be done right away. That sends the message, we can increase the rents then too. Our main idea is to make sure that we are giving value. Media centers, I forgot about that. I buy those $489 worth of Dell’s 27-inch all-in-ones for the media centers with nice tables and everything. Now we got residents using the media center and giving some positive reviews and using it otherwise with the printer and all.

Then the cafes. They are big in our communities to build cafes, curing machines, having some cookies and this and that and having the events every month. I always buy the dog waste stations. If we have pets in the property to put them out, they look nice and elegant. It also gives them a way that “We are a pet-loving community.” They are not splattering all over the place. Playground equipment is another one I go for to see if I can salvage the one which is there if it is possible or buy a new one and things like that.

[bctt tweet=”If you don’t set standards, people are going to take advantage of you.” username=””]

What are some critical things we should be thinking about that need to be done the first week? Are you talking about having that plan first week versus the second and third week?

The first week, we need to take care of the rents, residents and collections. Rents are important. We do not need to miss a beat because that’s the most important thing. In my books for property management, there are three things. One is rent collections, retention and responsiveness. We are quickly taking care of the responses. Three R’s of the often needs of the residents. Nothing goes away if they send in the work orders and we don’t have parts in the workshop or we are not getting taken care of within 24 hours. That’s important because retention is built with the responsiveness that we take care of them for the service order. Rents are collectible to reduce the delinquency.

I find about that concessions and delinquencies are the main factors in the rent collections. When we take over the property, we want to make sure that the rents are due by the 3rd. They are late in the 4th. The texts go out on the 1st. We’d like them even to start paying early on. It’s called before the 1st. We try even to give some raffle drawings. In other words, those residents who pay before the 1st, we put their name in the hat for $25 or $50 gift certificate. They love that. They start winning these things. Their behavior is changing now. That’s what we want. We want to change the behavior of the community believing that “I’m going to pay the rent. Let me pay a couple of days early.” It’s better for us.

We got it all ready tacked down in the bank. We are teaching them through signs. It depends on the community if it’s a sick community or a big community? Sending the text. Text service with Rent Manager is amazing. You could do text like this for the whole company. All 26 properties by clicking this one text, which is a bulk text. We design it, which goes out on 31st and on the 3rd and on the 5th. We do only three texts. They go to the whole company. We start getting all these responses back. We can control through this Rent Manager.

I haven’t heard anyone talk about doing a raffle for the ones who pay early.

The thing is we believe in referrals also. My daughter, Monica, is much involved. She’s a graphics person. We got graphic artists in the Philippines, who have been working with us. They design the websites. They design the marketing pieces. It has given me new knowledge over the last several years to be involved after the takeover. As syndicators we raise the money, we buy the property, but then we are only dealing with the managing. The manager maybe once a week for one hour or twice a month or things like that. In my case, being the CEO of the management company, I get to see everything, the fruit of the labor on a daily basis. Looking at their Monday morning reports, the delinquency report, everything. Our daughter has designed this beautiful Google Docs.

Everything is on one sheet. It’s in real time. When the manager puts it in, we can put in also, we can see it. It’s the most revolutionary thing my daughter has done. I’d love to share that. The key thing is we got to make it easy for our managers to manage. If they are feeling the pressure from the management company, they don’t do perform well. You show them, “Let’s make your job easier. These are the five important things we’re going to talk about every time. This is your slot. Tuesday morning from this to this.” We give one hour. We do training for our employees on Monday at 2:00 PM Central or 12:00 here on the Pacific coast. On Friday, we drag them right here who teaches the people in our team who are doing a great job in leasing, in advertising, in collections and fair housing laws?

We do all these different tapes. Our insurance company has portals that we also share with them. We did training on benefits. Our insurance company came and they gave a whole benefit. Everybody was on the Zoom meetings. We record them and put them in a Dropbox so that we can review them. Answering your question, the tension is huge. We give $200 to $300 referral bonus. Our twelve communities are in one generic, ten in Texas nearby and then we have two over there and we’re going to buy more. We have these cards with all the properties, pictures, addresses, phone numbers and everything. We give any resident, anybody who would like to give us a referral to any of the properties.

It doesn’t have to be in that community. We pay them $200 or $250 for the third month. It’s not right away. We don’t want them to get somebody in and then they leave us right away. After 90 days, we said, “Thank you so much, you referred to us. We are willing to give you now $250 off your rent or cash or whatever.” That’s something, referral bonus. We have also implemented something special I’d like to tell your audience about. This is a 5% discount to the local employees. Our leasing agents go and talk to them and say that “We would like to share with you if you share our community with your new employees, we give them a 5% reduction in rent.” We have beautiful flyers designed to communicate that with them.

We have marketing pieces galore. We have designed it to the T on how to promote the communities. We all love to talk about marketing. It’s important to market the asset and to get the traffic, not only the flagpoles. These are the 30-feet tall flagpoles that I like. I don’t like the smaller twenty-feet and the thin ones. I like to pay $700 or $500, $600 and get them from the manufacturer from Georgia. He was supplying, putting them on a trailer, sending them to me in Texas. He will send anywhere in the US. The good part is these are statement flags. They are huge, nice. I like the big one, 6×4 or 8×4 flag flying on my properties with the lights underneath. We light up the signage and everything.

The good part is how to advertise. Apartments.com don’t pay me any money, but in Apartments.com, 87% of the people looking for an apartment or a community they want to live in, they put Google. They say, “I want an apartment in Angleton, Texas or Houston, Texas.” Apartments.com maybe the first one you will see. I hear that CoStar owns Apartment.com or vice versa, something like that. CoStar bought LoopNet also. All these are intermixed together. They have the best company. They send their photographers to your property. They take professional pictures, 3D pictures. They put their website right there.

The best part is, Whitney, they all also have a service when people email and call, when the people pick up the phone at the property, they record every single call. We use those calls to train our leasing agents and assistant managers. We share with them not to dock them, but they know that on the backside administration is also watching. How many people were coming there and getting cut off or how much they were had to wait before somebody picked up the phone? All of those things.

What service does that?

For $300 a month or $350 a month, it’s the best service ever. The best part is that you can put all these available units. They have a very good setup. Apartments.com is the name.

[bctt tweet=”It’s important to market the asset and to get the traffic.” username=””]

Apartments.com records the calls, they do that?

They do it all in the service. Everything is in the service. It tells you graphically also as the owner, how many people emailed. You could click on the emails. You could even send the pieces in a beautiful media center. You could even reply back through the software. They could send digital brochures in color right back to the property who are inquiring from the Apartments.com. It’s one of the best services I’ve ever seen.

There are so many things there that I’ve never heard of it. I did not know that they can record the calls. That they would do all that stuff for you. Anything else you want to add about taking over the property and the marketing specifically?

I would say marketing. We need to be presenting our property and doing the market comparison, rent comparisons. We do it every middle of the month. We have to look at what other properties prospective residents are going to. I try to tell my teams. I also buy digital frames. In every office, you will see some beautiful frames all around. A digital frame is showing the model unit, the community and the playground all 24 hours when they open up. We teach them also how to walk the walk as the residents come into the model unit. Is everything intact? Are the lights on?

Back up the refrigerator off the set of the model unit with candy bars, water bottles and Cokes. When we are showing this prospective resident, we show them and they look at it and say, “Please go ahead and pick up a small gift.” A small thing, but it goes a long way. We are giving them something also like a brochure. We believe in lots of marketing materials and brochures. Then we have lots of different plans. I could do a whole two, three, four different lectures on how we use this. All techniques that we have perfected over the years to manage.

I would have learned a lot by going and fake shopping or tenant shopping your properties, Vinney. I’m learning from your managers. When they don’t know that’s what I’m doing. Vinney, thank you so much for your time. You’ve got lots of good points here, from the security bond to the Rent Manager, the software and how important that is, sending out the letters to the residents, the referral bonus, putting people on a raffle that pay early. There are some great points and then also the marketing. How can readers get in touch with you and learn more about how you’ve perfected this business?

Thank you, Whitney. They can always join my academy. I built a very strong academy. I’m over 700 lectures now. We are recording even a lot more on the management side of it. My academy has been mostly deal-finding and coaching. My main thrust is also to record the management side of the academy, which is MultifamilyManagementAcademy.com that I have the domain name. They could text the word LEARN to 474747 and my team members will get back to them right away. We could talk to them and see where their needs are. My email address is Vinney@VinneyChopra.com.

Vinney, you’re generous in giving out your email. I hope the readers will connect with you. Go to Life Bridge Capital and connect with me and go to the Facebook group, The Real Estate Syndication Show, so we can all learn from experts like Vinney and other guests that we’ve had on the show. It’s been a pleasure to have you on the show, Vinney.

Thank you, Whitney.

Important Links:

- Vinney Chopra

- Rent Manager

- RealPage

- Yardi

- AppFolio

- Craigslist

- Apartments.com

- CoStar

- LoopNet

- MultifamilyManagementAcademy.com

- Vinney@VinneyChopra.com

- The Real Estate Syndication Show

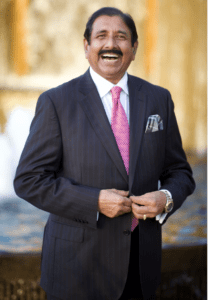

About Vinney Chopra

Vinney (Smile) Chopra, a founder and Chief Executive Officer of 3 companies and President of 2, came to the USA with $7 in his pockets. He has over 35+ years of Real Estate experience and 15+ years of Multifamily Syndication Investing & Managing experience including overseeing the management of $220 Million in real estate assets. MONEIL PREMIER COMMUNITIES are all Self-MANAGED by Vinney’s well trained 67 full-time professionals along with thousands of contractors and vendors!

Vinney (Smile) Chopra, a founder and Chief Executive Officer of 3 companies and President of 2, came to the USA with $7 in his pockets. He has over 35+ years of Real Estate experience and 15+ years of Multifamily Syndication Investing & Managing experience including overseeing the management of $220 Million in real estate assets. MONEIL PREMIER COMMUNITIES are all Self-MANAGED by Vinney’s well trained 67 full-time professionals along with thousands of contractors and vendors!

His expertise includes picking right markets, underwriting well, raising $5 million to $8 million in a couple of days, negotiations for Win/Win/Win, driving corporate growth strategy, investor relations and asset management, and business & culture development.

Vinney is passionate to coach and mentor and teaches his skills to other investors so that they don’t make the mistakes he made. Vinney has an undergraduate degree in Mechanical Engineering and a Master of Business administration degree from The George WashingtonUniversity. He lives near San Francisco, married 39 happy years to Kanchan and have two great grown-up children.

If you want to learn or invest with Vinney, text “Syndication” to 47 47 47‼️