During the onset of the Covid-19 pandemic, lockdowns worldwide have caused most commercial spaces to close down. As countries around the world started their vaccination program, there is a high hope that the economy will bounce back and commercial spaces will reopen again.

A Guide to Passively Investing in Commercial Real Estate

Get your free copy of “A Guide to Passively Investing in Commercial Real Estate”. Inside you’ll learn the basics of passive income and real estate syndication, what kind of returns you can expect, how to find a sponsor and how to evaluate the risks. Download your copy in the show notes or visit lifebridgecapital.com/investbetter to start your investment journey.

Watch the episode here:

Listen to the podcast here:

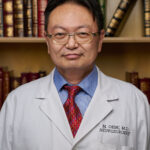

In this episode, we find out from real estate investor, author, neurosurgeon, Masaki Oishi, why it is still a good idea to invest in commercial real estate. Masaki is also the co-founder and chairman of MarketSpace Capital, where he is responsible for directing major capital transactions and manages the investment committee. Masaki says for you to be successful in commercial real estate investing, you must choose your properties and sub-markets well, and it helps to have a plan. He also gives guiding principles when looking for properties. Listen now and find out why commercial real estate is a good option for you to invest in now!

Key Points From This Episode:

- Masaki talks about his journey in real estate — he started as young as 15 years old.

- Masaki explains why it is important to start giving your child experience in business as early as their teenage years.

- Masaki talks about the current economy and how it affects the real estate industry.

- Masaki emphasizes looking for ways to take advantage of the current economic situation.

- How Masaki targets his market right now?

- Why targeting the middle-class renters an advantage right now?

- Masaki’s guiding principles when looking for properties — affordability of the housing, sustainability, and inclusivity.

- Some important metrics in real estate — location, local crime, education, and accessibility.

- Masaki’s predictions in the real estate market over the next six to twelve months.

- Why is it still prime time to invest in commercial real estate?

- How does the Central Bank affect real estate investors?

- What other asset classes do Masaki consider investing in?

- What is the biggest risk in investing in commercial real estate right now?

- How does Masaki prepare for a downturn?

- Masaki shares his best source of finding real estate deals and new investors.

- How does Masaki like to give back?

Tweet This!

“I do try to get them some real-world experience, usually 14 or 15 years of age, I start them out. It doesn’t matter what kind of job or responsibility you give them, just as long as you make sure that they take them seriously.” [0:02:10]

“We look at properties with some guiding principles. One of course is the affordability of the housing that we intend to produce. But, also we look at other factors like sustainability and also we wanna make sure that it’s inclusive.” [0:05:52]

“Location is the most important metric in real estate.” [0:07:10]

“We want to make sure that we buy the property right.” [0:15:30]

Links Mentioned in Today’s Episode:

A Doctor’s Guide to Commercial Real Estate

About Masaki Oishi

Masaki Oishi, MD, Ph.D. is a neurosurgeon in Houston. He received his medical degree from Cornell University and his Ph.D. in Molecular and Cellular Neuroscience from The Rockefeller University.

Dr. Oishi has practiced medicine for decades and is currently a partner at the Kraus Back and Neck Institute. He is also the recipient of many awards and recognitions in the field of medicine and surgery.

Though Dr. Oishi is a trained neurosurgeon with decades of experience, his other passion is real estate, which is something he’s been involved in since he was 15-years old.

He has successfully invested and sold commercial properties over the last 30-years and has amassed a real estate investment portfolio of over $250 million in assets.

Additionally, Dr. Oishi is the co-founder and chairman of MarketSpace Capital, where he is responsible for directing major capital transactions and manages the investment committee.

Full Transcript

EPISODE 977

[INTRODUCTION]

0:00:00.0 ANNOUNCER Welcome to the Real Estate Syndication Show. Whether you are a seasoned investor or building a new real estate business, this is the show for you. Whitney Sewell talks to top experts in the business. Our goal is to help you master real estate syndication.

And now your host, Whitney Sewell.

[INTERVIEW]

00:00:24.000

Whitney Sewell: This is your daily real estate syndication show. I’m your host, Whitney Sewell. Today our guest is Dr. Mas Oishi. Thanks for being on the show, Mas.

00:00:33.000

Masaki Oishi: Pleasure to be here. Thank you for having me.

00:00:35.000

WS: Yeah, honored to have you on the show. Mas is not only a neurosurgeon in Houston, but he is also the co-founder and chairman of MarketSpace Capital. He has successfully invested in so commercial properties, over the last 30 years and has a master real estate investment portfolio of over 250 million in assets. He just released a new book called Prescribing Real Estate: A Doctor’s Guide to Commercial Real Estate, love that name, Mas.

Welcome to the show. Give us just a couple minutes of your background this 30 years, you know, also you’ve been a neurosurgeon at the same time. I’m sure that takes a few hours a week away from your real estate business there, right? But give us a little background.

00:01:16.000

MO: I basically started in real estate, when I was 15, of course the real estate belonged to my parents then since they were recent immigrants to the United States, it fell on the eldest member of the siblings of the immigrant family to take care of the real estate, and so yeah I got exposure to things like collecting the rent and making sure the insurance was paying, property taxes were paid. At a fairly young age, I think a lot of Asian families encourage their children to get involved with this kind of, you know, business experience early on in life and certainly my family was no exception.

00:01:53.000

WS: I wish more families got children involved in the business, right? Or in a business or just to think that way. And any tips around that? Or I…did you do that as well? Or if you have children? Or any thoughts around that?

00:02:04.000

MO: Yeah, I have three children. Sometimes it feels like I have more than three children, but I do try to get them some real-world experience. Usually around 14 or 15 years of age I start them out. It doesn’t matter what kind of job or responsibility you give them just so long as you make sure they’re taking that seriously and I think that’s an experience that, you know, they’ll carry with them no matter where they go.

00:02:29.000

WS: For sure. Well I know you are moving into the real estate business a long time and have invested in many different projects, no doubt and in a very experienced. You know, wanted to hear just a little more the economic side or just your thought process behind, you know, the economy right now and how you know maybe places you’re gathering data and how you come to those conclusions and stop into just some conversation around that at the moment.

00:02:51.000

MO: Right, well I think fundamentally, our economy did take a bit of a hit from the recent COVID crisis, and you know we are still in many ways, climbing out of the bit of recession that that brought with it. There are some sub sectors of the economy if you will that suffered more than others, including hospitality and travel. Those kinds of industries are still trying to dig their way out. On the other hand, what we’ve seen in terms of real estate, not real estate market itself, is record low interest rates and very high demand for housing. I’m still having a hard time reconciling those two realities, but it is what it is. And we’re actually looking at ways to take advantage of some of the opportunities that we see, especially in sub sections of the real estate markets such as multifamily housing.

00:03:49.000

WS: Could you…you know that that’s a great place for you to elaborate as well, like you said, looking for ways to take advantage of this. Could you elaborate on like where do you see those advantages? What advantages specifically are you trying to take advantage of?

00:04:00.000

MO: Right. Well, as I said right now the demand for housing, almost every single kind of housing, is very strong. And we’ve seen…if you want to look at the, the economic data, we’ve seen a compressioning cap rates. We’ve seen, you know, the studies showing that the deficit of rental apartments and condominiums for the next 10 years is probably the order of millions of units, and so there is a strong demand, not just have president but also going forward for housing. And, you know, we like to focus, at MarketSpace Capital, we like to focus on a model that we call attainable housing, whereby we target middle class renters, who seem to be, you know, the most intense segment of the population when it comes to, you know, going after real estate, and also, it’s the fastest growing segment that we see in terms of demographics.

00:04:59.000

WS: Yeah, targeting the middle class renters. You know, how are you all picking your markets right now? Are there markets that you’ve been involved in for a long time? Or did that change, you know, over this past, you know, pandemic and year?

00:05:11.000

MO: Right. Well, I mean we are based in Houston, which, you know, I’ve been told many, many times that we’re lucky sons of guns because, you know, this is the kind of market where you can pass it a cat, and you’re going to hit some property that’s interesting in terms of its value and usage. But, all joking aside, I think we have been fortunate but we’re not just looking at Houston. We also have projects going on in Dallas – Fort Worth area, and also in other states including Las Vegas, and, you know, we’re also looking at different parts of the country not just the South with the Southwest. So, you know, we look at properties with some guiding principles. One of course is the affordability of, of you know, the housing that we intend to produce, but also we want to look at other factors like sustainability and also want to make sure that it’s inclusive, that you know, perhaps renters who have medical issues or senior citizens can also have access to those kinds of projects. So, we have a panel of econometrics that we use to determine whether or not, you know, a property is suitable for the kind of investment we’re looking for. We actually look at somewhere between 28 to 33 parameters including things like local crime rates and education – quality of education, but you know I can’t divulge the actual formula for that because that’s propriety.

00:06:46.000

WS: You know that was gonna be my next question, right? I want to hear all those metrics. Well, is there just, I mean, one or two metrics that you can share? That maybe you all have, you know, seen that’s been extremely crucial? Or maybe a major red flag when you see this type of metric in a property or market?

00:07:04.000

MO: Right. Well, I wouldn’t necessarily call it metric but of course you know, location is the most important metric in real estate for my money. But we also look at things like, as I said, you know, local crime, quality of education, as well as accessibility to things like public transport, or the highway system. There are all kinds of metrics that we look at and there are each way that differently and we don’t necessarily use every single metric for every single property that we evaluate, but I think, you know, we’ve come up with our own formula that makes sense for us, for what we want to accomplish. And so that’s kind of what separates our approach from other private equity firms or venture capital firms, or even real estate investment trusts who take more of a shotgun approach. Not that that’s a bad approach, but we like our own approach a little better.

00:08:01.000

WS: Yeah, I like having a plan. I know that having something like that gives you some guidance. I think you’re going to be a lot further along well. What about, you know, just from what you know what’s happened, just from your experience over many years now and what’s happened over this past year, you know, what are your projections? Were your thoughts over the next six to 12 months just in the real estate market?

00:08:19.000

MO: Well, I think a lot depends on which segment of the market you’re looking at. Obviously, even before COVID struck the retail sector was definitely facing some tough times. I think a lot of that has to do with the advent of e-commerce and how it’s becoming easier and easier to fulfill a lot of your shopping needs just by ordering things over the internet. You know, it’s not necessarily good or bad, it’s just different. And with change, there are going to be winners and losers and I’m afraid that a lot of the big box retailers, were already taking it on the chin, and certainly with the coronavirus endemic, that didn’t help their cause much either. So, I would say, you know, even in a depressed type of sub segment of the market like retail, if you can find bargains and if you like the property and you know, you know what you’re doing, then there’s certainly nothing wrong with was trying to create a project or business out of, you know, what you feel has value and what other people, like you know, guys sitting in an office in Manhattan, many thousands of miles away from where you are, probably don’t see what you see. So, it’s one of those areas where if you know what you’re doing, and you know things that other people don’t know that you certainly have an advantage, and I would not say you know don’t invest in commercial, you know, retail properties right now. There are bargains to be had, I’m sure.

We take a different approach. We like to shift our resources into the segments of the market that are currently hot, if you will, and certainly multifamily and industrial, in terms of warehouse and distribution type properties are very much in the hot spot, if you will, with today’s market.

00:10:11.000

WS: Yeah. So, you still…you believe right now, I mean, it’s still a prime time to be investing in commercial real estate?

00:10:16.000

MO: Well, if they…if you choose your properties or if choose your sub markets carefully, and obviously it helps to have a plan. We like the econometric model that we use, and so we’re very confident going forward. I have seen nothing to suggest that the low interest rate environment, that the environment that we see now, where, you know, there’s a lot of capital floating out there, chasing investments. I have not seen anything that would make me think that environment would change so quickly. I think there’s still a lot of countries on lockdown, there’s still a lot of countries are dealing with coronavirus. I think, most recently India, you know, one of the most populous countries in the world is going through quite a bit of trouble with managing the crisis. And so, you know, the central banks tend to respond to crises by printing money and keeping interest rates low, I think that sort of mindset is likely to continue for the foreseeable future.

00:11:18.000

WS: Any thoughts on that right there, as far as how the central bank’s affect, maybe you as the commercial real estate investor?

00:11:24.000

MO: Well, obviously central banks control the flow of money and the cost of money in terms of short term interest rates. Now, you know, is it possible that worldwide inflation could suddenly spark and long term interest rates rise and upset the entire apple cart. Certainly it’s possible, but I would say looking at the trend of the past 10 years, what we’ve seen is more of a deflationary scenario when it comes to basic goods and services, that is what is measured by things like the CPI which is put out by the Bureau of Labor Statistics. The official inflation rate has been less than 2% for the last 10 years on average, probably even longer than that.

Now that’s not to say that inflation doesn’t exist. I do believe it does. It’s just in the categories of things that aren’t necessarily reflected in the CPI. The cost of higher education for example, that’s not reflected in CPI at all. And the cost of healthcare makes up only 7% of consumer price index. So, you know, there are a lot of things that we look at all. If you want to live a middle class, upper middle class lifestyle that don’t necessarily jive with the basket of goods and services that the government looks at when calculating the official inflationary.

00:12:47.000

WS: Are there some specific places where you gather data? So you can better understand what’s happening like that.

00:12:53.000

MO: Oh, we definitely, you know, attend various webinars, and we listened to the experts, you know, the Wall Street Journal is one of my favorite reads. I know it’s really boring for some people, but I tend to find that fascinating. But yes, I mean we, we look at the economy both on the macro scale and also we look at local markets as well. I think…we have our advisors, we have plenty of business joint venture partners that…

00:13:21.000

WS: Sure.

00:13:21.000

MO: We send to. We have quite the network of people on various rungs of, you know, the size of the economy, whether they’re looking at the entire stock market or whether they’re looking at, you know, just the property down the street from our office building. We get a lot of input. And, of course, you know, we like that. That’s, you know definitely keeps us alert to opportunities as well as, you know, possibly, any impending adverse events that might be coming our way.

00:13:53.000

WS: Are you investing in anything outside real estate right now?

00:13:55.000

MO: Well, we’re actually looking for properties that could be used for warehouses…

00:14:01.000

WS: Okay.

00:14:01.000

MO: For distribution centers. You may have noticed that Amazon and other big retailers like Walmart are kind of on the building bench right now they, they’re buying up properties, so that they can meet their expanding needs and an e commerce. And so, that’s not a bad segment of the real estate market to focus on either if you’re looking to buy.

00:14:24.000

WS: What would you say is the biggest risk right now? Getting into the commercial real estate market.

00:14:28.000

MO: Well, I think there has been quite a bit of appreciation acid inflation, if you will. Some of it is due to demographics in the Texas area, I’m just giving an example. Some of it’s also due to easy money or, you know, the ability to borrow a very low rates. There’s also quite a bit of, you know, foreign capital, that’s interested in buying into investments here in the States, so it’s easy for some properties to become inflated. And, you know, the danger I think is in chasing a property that is so high, that has generated so much interest that a lot of investors, perhaps lose sight of, you know, the old maxim you should buy low and sell high, not by high and trying to sell even higher. So that’s, you know, kind of what we look out for in terms of avoiding that kind of scenario. We like to make sure that we buy the property right and what we found is, you know, that’s really where we make money. You know, it’s uncertain network price we can sell a property but we can sure control the price of which we buy property.

00:15:41.000

WS: Now that’s well said, no doubt about it. And I know we’ve talked about this a little bit, but just, you know, say it happens again, there’s another pandemic, you know, I carry you all preparing for a downturn or maybe you know the way you’re buying a property like you mentioned or other things that, you know, help you prepare for potential downturn.

00:15:56.000

MO: Right. Well, I mean, quite frankly, even during the 2020 year, we basically move forward with projects. We found that there was still a strong interest in the projects that, that we were bringing forward from our database of investors that we built from the ground up. We focused mainly on high income or high net worth individuals who essentially had never invested in real estate before, and we found that the response to what we were putting forward in terms of opportunities was quite encouraging. So I would say that in terms of things like macroeconomics, yes it is a concern that, you know, spending could slow down or that, you know, the government may not catch up with the needs of people who’ve been displaced because of lost of wages, and that stimulus may not catch up to what’s required in order to keep the economy moving. That’s certainly a concern but when it comes to the actual housing market, there’s still a lot of interest from investors. And, you know, the rental market remains strong. So I think, you know, those are encouraging signs for us. It’s not an absolute guarantee obviously, but we look at that and, you know, we’re hopeful that we’ll be able to weather out the entire coronavirus crisis, even if it is prolonged by another year.

00:17:17.000

WS: What’s your best source for finding new deals right now?

00:17:21.000

MO: Well, it used to be word of mouth because one of our partners, David Rodarte, he had been a broker in Houston for many years before he became our Managing Director. So he’s got a tremendous network, other brokers who bring us all kinds of projects to look at. I would say, we probably say no nine times out of 10 before we even start evaluating the property. And that doesn’t make me very popular but it is, you know, how we…how we become very selective about what sort of investments that we know we try to develop and put in front of our investments.

00:18:00.000

WS: Makes you more popular with investors though.

00:18;02.000

MO: I would hope so because it’s a lot of work.

00:18:05.000

WS: Yeah. Mas, any daily habits that you are disciplined about that have helped you achieve success?

00:18:10.000

MO: Well, I think it’s comes down to humility and hard work. I mean, I go to work every day understanding that I can’t do this alone, that I’m dependent on my partners and the employees that I have. And we are in turn dependent on our investors and, I have to say that I’ve done my time running small businesses before, mainly the form of medical offices, and I really didn’t enjoy that because it’s such a over regulated type of business. You know, medicine is branch one of the most regulated industries that we have in America. And I’m just so thankful that, you know, I’ve been given the opportunity to focus more on big picture concepts and given the chairmanship, which I really don’t deserve but nobody else wanted it, so I’m happy to take.

00:19:05.000

WS: I love your answer, this humility and hard work. Those two things can just take you so far. I just love that answer, but what’s your best source for meeting new investors right now?

00:19:13.000

MO: Well, I started basically by contacting those doctors that I had met over the years, and you know really almost cold calling them. I mean, they’re usually receptive to the idea of investment opportunities, but I had no idea that this was going to work. So, you know, we kept expanding the network based on what kind of responses that we received, so doctor really liked what we were proposing in terms of an investment. We immediately asked him to get us in touch with others in his circle, who might also share that kind of interest in investing. So that’s how we did it, we really just did organically from the ground up, you know, a lot of phone calls were involved. And, you know, there was a lot of rejection as well. I mean, there are some doctors who just want nothing other than to be left alone in their private time. So, now, there was a lot of trial and error the beginning, but now we’re kind of very happy that we did it because we have a very strong network, very strong database of investors that we can go to and that database continues to grow.

00:20:24.000

WS: How do you like to give back?

00:20:26.000

MO: Well, I like to give back by being as transparent as possible. I really don’t like the model that certain private equity companies or RITS sews. I mean, you know, I’ve invested in RITS before I’m sure we all are familiar with, with their model but it’s so much like a mutual fund, you know, you give your money to people and do you really know where your money is on any given day? I don’t. I mean, you can check the quarterly prospectus, you can see what percent went to which company, things like that. But, you know, that’s not the level of transparency that I think a lot of investors are looking for. I think they really want to see their investment in action. And, you know, we’ve gone so far as to set up video cameras at construction sites for the projects that we’re developing so that you know our investors can actually get a day today, you know, progress report with their own eyes.

00:21:23.000

WS: That’s really neat. I’ve heard of a few groups doing that, but not too many. That’s really neat so investors can log in and see, just really see alive what’s happening.

00:21:33.000

MO: Exactly, right.

00:21:35.000

WS: Yeah, what kind of feedback have you received from that? I just wonder.

00:21:37.000

MO: Well I think, it’s been mostly very positive. There are a lot of investors, I’m sure, who are happy with the idea of putting money into a fund and then trusting the fund managers to, you know, work their magic and make their returns happen. But I think there’s also quite a substantial number of investors who like to see and feel and be a part of the story. And that’s great because, you know, those investors have passion, and those are the investors that we like.

00:22:08.000

WS: Yeah, no doubt about it.

Well, I appreciate your time today, Mas. It’s a pleasure to meet you and just appreciate you sharing just your thoughts on the economy and different things that have happened, how that’s affected your business and moving forward, and even your panel of econometrics that you use. A couple of those things that maybe we can get you back on and pull out a few more of those.

00:22:29.000

MO: You know this went by so fast I guess, and I was having so much fun but I really do appreciate your having me. Yes, I mean, there’s other topics that I’d be happy to.

00:22:38.000

WS: Yeah, definitely would be great, but yeah, it does go by fast and we’re grateful for your time. Tell the listeners how they can get in touch with you or learn more about you.

00:22:46.000

MO: Well, our company’s called MarketSpace Capital. You can reach us on the web at marketspacecapital.com. I’m also author of a book which is on Amazon, you can access that information from our website as well. But I’d say, you know, our target audience for the book is not necessarily just doctors, but professionals who, you know, are good at what they do and generate lots of income, but are unsure about how to get to a point where you don’t have to rely on that income anymore. I think that’s our target audience there.

[END OF INTERVIEW]

[OUTRO]

0:23:24.0 ANNOUNCER: Thank you for listening to the Real Estate Syndication Show, brought to you by Life Bridge Capital. Life Bridge Capital works with investors nationwide to invest in real estate while also donating 50% of its profits to assist parents who are committing to adoption. Life Bridge Capital, making a difference one investor and one child at a time. Connect online at www.LifeBridgeCapital.com for free material and videos to further your success.

[END]

Love the show? Subscribe, rate, review, and share!

Join the Real Estate Syndication Show Community: